maryland ev tax rebate

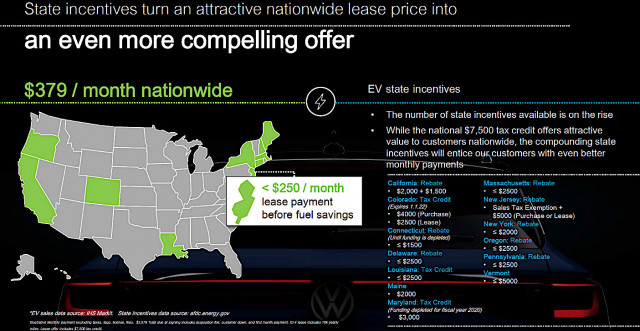

Through our EV toolkit you can use savings calculators to compare the cost of gas-powered versus electric-powered vehicles review the latest EV brands and models learn the basics of EV charging and view state and federal tax incentives. The amount of your federal tax credit will vary based on the particular brand or type of EV you buy depending on the capacity of the battery used to power the vehicle.

Incentives Maryland Electric Vehicle Tax Credits And Rebates

The program is designed to expand New Jerseys growing network of electric vehicle infrastructure allowing residents businesses and government agencies to purchase and drive electric vehicles.

. Federal EV tax credits of 2500-7500 are available for new EVs and plug-in hybrids but not for hybrids. EVsmart is your one-stop shop for all things EV-related. Virginia legislators took their first vote Tuesday on the gas tax holiday proposed by Gov.

California advances bill allowing farmworkers to vote by mail in union elections. Through our EV toolkit you can use savings calculators to compare the cost of gas-powered versus electric-powered vehicles review the latest EV brands and models learn the basics of EV charging and view state and federal tax incentives. EV Savings Benefits.

Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. Commercial or multi-unit dwelling customers who purchase and install EV charging stations can receive up to 6000 for each charger and up to four rebates. In California the Clean Vehicle Rebate Project offers 2500 for the purchase or lease of a zero.

Electric Vehicle EV Charging Station Rebate - Glendale Water and Power GWP GWP provides rebates to commercial and residential customers toward the purchase of Level 2 EV charging stations. For 2021 Colorado offered a tax rebate of 2500 for a vehicle purchase and 1250 for a lease. California lawmakers announce budget agreement 10 billion taxpayer rebate.

Tribune Content Agency is pleased to announce Patti Varol as editor of the Los Angeles Times Crossword. The tax credit is currently set at 26 of your total system cost. EVsmart is your one-stop shop for all things EV-related.

It Pay to Plug In provides grants to offset the cost of purchasing and installing electric vehicle charging stations. Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. Electric Vehicle Supply Equipment EVSE Rebate Program.

As of July 1 2017 allows purchasers of qualified vehicles to apply for a tax credit of up to 3000 calculated as 100 per kWh of battery. The Maryland excise tax credit expired on June 30 2020 but could be funded in the future. Electric Vehicles Solar and Energy Storage.

The 12 Republicans on the committee repeatedly. Glenn Youngkin nearly a month after the governor announced it and with the timeline for a final vote still up in the air. Offers individuals 700 for the cost of acquiring and installing qualified charging equipment.

To get the state rebate. Department of Energy all-electric vehicles that you purchase new may be eligible for a federal income tax credit of up to 7500. According to the US.

The federal solar tax credit is a tax credit that you can claim on your federal returns. A large portion of the relief package 115 billion is dedicated to tax refunds for Californians and includes the governors rebate proposal announced in March to send 400 checks to every registered vehicle owner with a cap of two checks per individual. Complete the ElectricalVehicle.

Local and Utility Incentives. This tax credit is not valued at a set dollar amount. Many states also offer incentive programs for new EV.

California looks to unburden manufacturers from nations highest sales tax. Credit rating agencies note Californias strong revenues warn of headwinds. The credit applies to the year you buy the vehicle and your tax credit is capped at how.

Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer. Rather its a percentage of what you spend to install a residential solar photovoltaic PV system. Use of High Occupancy Vehicle HOV Lanes As a driver of a plug-in electric vehicle titled and registered in Maryland you are allowed to use all HOV lanes in Maryland regardless of the.

Plug-In Electric Vehicle PEV Tax Credit. In its first General Assembly hearing the legislation cleared the House Finance Committee on a party-line vote. EV Savings Benefits.

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Maryland 1 700 Residents Take Advantage Of State S 600 To 1 000 Ev Excise Tax Credit Insideevs Photos

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

Rebates And Tax Credits For Electric Vehicle Charging Stations

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Maryland Solar Incentives Md Solar Tax Credit Sunrun

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Arcimoto Vehicles Reclassified As Autocycles In The State

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Vw Is Launching Id 4 Electric Suv On Up Front Value And Ownership Costs Not Tech Potential

2022 Ev Tax Credits In Maryland Pohanka Automotive Group

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price